Banks and Interest Rates

Banks interest rates – Banks play a crucial role in the financial system by intermediating between savers and borrowers. They collect deposits from savers and lend them out to borrowers, earning a spread between the interest rates they pay on deposits and the interest rates they charge on loans. This spread is a key source of revenue for banks, and it is influenced by a variety of factors, including the overall level of interest rates in the economy, the creditworthiness of borrowers, and the competitive landscape in the banking industry.

Banks use interest rates to manage their risk and profitability. By raising or lowering interest rates, banks can influence the demand for loans and the supply of deposits. When interest rates are high, borrowers are less likely to take out loans, and savers are more likely to deposit their money in banks. This can reduce the risk of banks making bad loans and increase their profitability. Conversely, when interest rates are low, borrowers are more likely to take out loans, and savers are less likely to deposit their money in banks. This can increase the risk of banks making bad loans and reduce their profitability.

Factors Influencing Banks’ Interest Rate Decisions

There are a number of factors that influence banks’ interest rate decisions, including:

- The overall level of interest rates in the economy: When interest rates are high, banks typically raise their own interest rates to attract deposits and reduce the risk of making bad loans. Conversely, when interest rates are low, banks typically lower their own interest rates to encourage borrowing and increase their profitability.

- The creditworthiness of borrowers: Banks typically charge higher interest rates to borrowers who are considered to be risky. This is because risky borrowers are more likely to default on their loans, which can lead to losses for banks.

- The competitive landscape in the banking industry: Banks compete with each other for deposits and loans. This competition can put pressure on banks to lower their interest rates in order to attract customers.

Types of Interest Rates: Banks Interest Rates

Interest rates, as discussed earlier, play a crucial role in the financial landscape. Banks offer various types of interest rates, each tailored to specific financial products and circumstances. Understanding the different types of interest rates and their implications is essential for making informed financial decisions.

Fixed Interest Rates

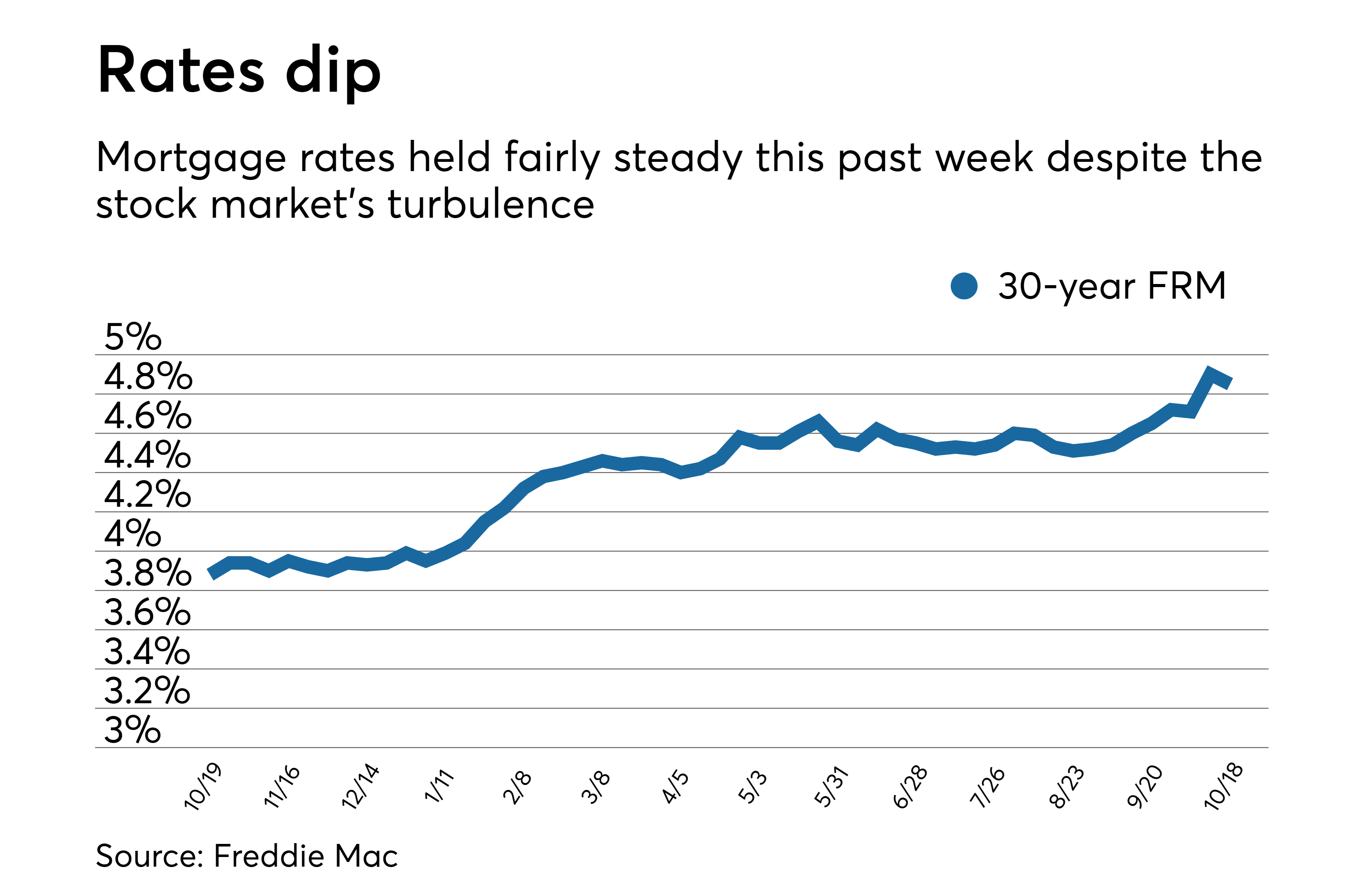

Fixed interest rates, as the name suggests, remain constant throughout the loan or investment period. They provide stability and predictability, making them suitable for individuals seeking a steady and predictable financial environment. For instance, a fixed-rate mortgage ensures that your monthly payments remain the same over the life of the loan, regardless of market fluctuations.

Variable Interest Rates

In contrast to fixed interest rates, variable interest rates fluctuate based on market conditions and economic factors. They are often tied to a benchmark rate, such as the prime rate or LIBOR (London Interbank Offered Rate). Variable interest rates offer the potential for lower payments when rates decline but also carry the risk of higher payments if rates rise. Adjustable-rate mortgages (ARMs) are a common example of variable interest rate loans.

Impact of Interest Rate Changes, Banks interest rates

Interest rate changes have a significant impact on various financial products and investments. Rising interest rates generally lead to higher borrowing costs for consumers and businesses, making it more expensive to finance loans and investments. On the other hand, falling interest rates can stimulate economic activity by encouraging borrowing and spending.

For example, when interest rates rise, the value of fixed-income investments, such as bonds, tends to decline as investors seek higher returns elsewhere. Conversely, falling interest rates can boost the value of these investments, making them more attractive to investors.

Understanding the different types of interest rates and their impact on financial products is crucial for individuals seeking to manage their finances effectively and make informed decisions about borrowing, saving, and investing.

Impact of Interest Rates on the Economy

Interest rates play a pivotal role in shaping the trajectory of an economy. They influence economic growth, inflation, and the overall financial landscape. Central banks, such as the Federal Reserve in the United States, assume the responsibility of managing interest rates to foster economic stability and achieve desired macroeconomic outcomes.

Interest Rates and Economic Growth

Interest rates have a direct impact on economic growth. Lower interest rates encourage borrowing and investment, stimulating economic activity. Businesses can access capital at a lower cost, enabling them to expand operations, hire more employees, and contribute to overall economic growth. Conversely, higher interest rates discourage borrowing and investment, leading to a slowdown in economic activity.

Interest Rates and Inflation

Interest rates also influence inflation, the rate at which prices for goods and services rise over time. Higher interest rates make borrowing more expensive, reducing consumer spending and demand for goods and services. This can help curb inflation by limiting the amount of money in circulation. On the other hand, lower interest rates stimulate spending and demand, potentially contributing to inflationary pressures.

Central Banks and Interest Rate Management

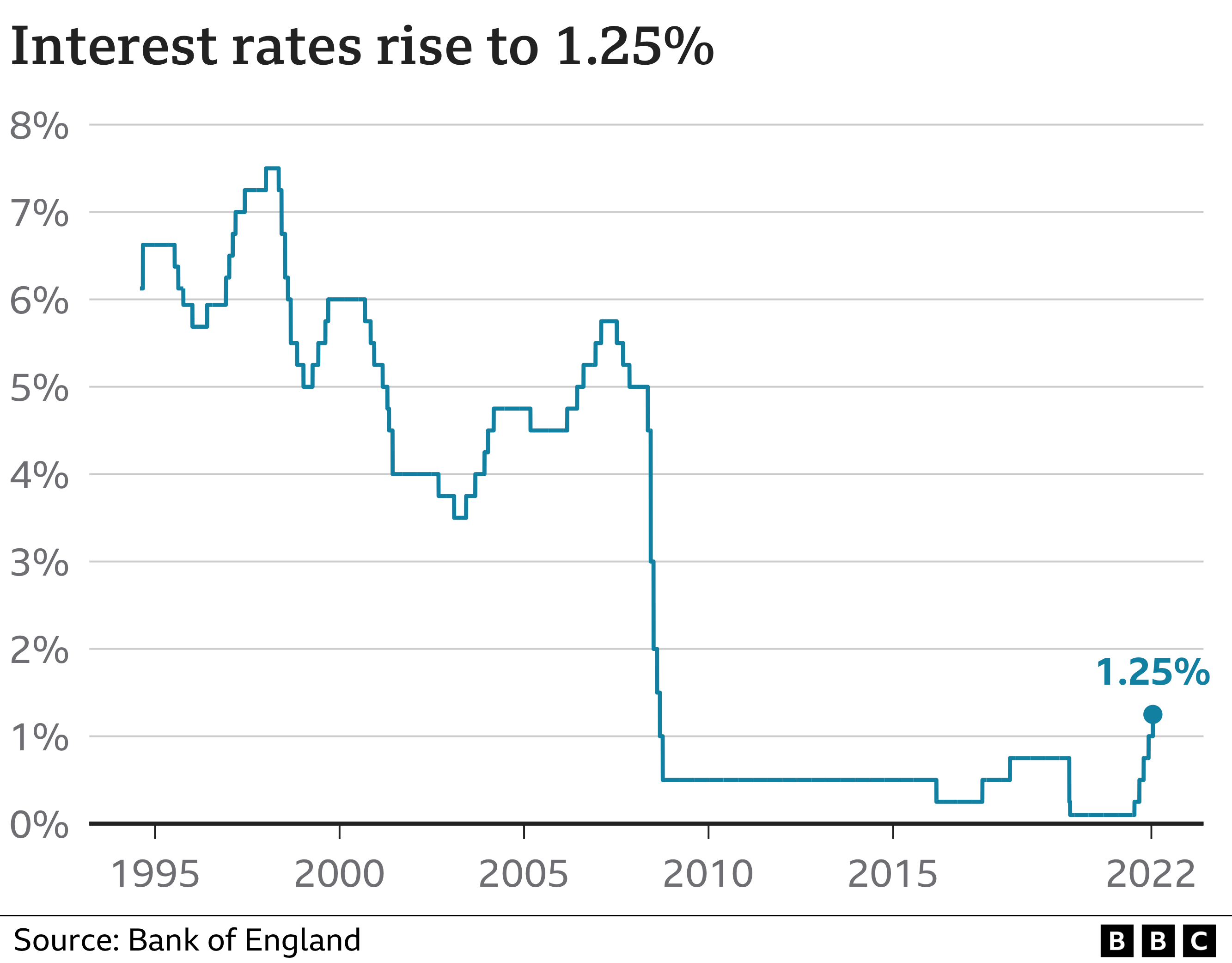

Central banks play a crucial role in managing interest rates to achieve economic stability. They use monetary policy tools, such as open market operations, to influence the supply of money in the economy. By increasing or decreasing the money supply, central banks can adjust interest rates to meet specific economic objectives. For instance, during periods of economic slowdown, central banks may lower interest rates to stimulate growth. Conversely, when inflation is a concern, they may raise interest rates to curb spending and demand.

Examples of Interest Rate Impacts

- The Federal Reserve’s decision to lower interest rates in 2008 helped mitigate the impact of the global financial crisis and supported economic recovery.

- In 2018, the European Central Bank raised interest rates to curb inflation, which had been rising due to increased consumer spending and demand.